With us, your take-home pay is well managed.

Focus on what you do best and let us take care of your payroll, tax compliance, social security, and immigration needs.

Global payroll solutions

Relocating to a new country for work can be overwhelming, especially for those experiencing it for the first time. An umbrella company offers the simplest payment solution for most employees and contractors. After accepting an assignment, you might need to select an umbrella company.

This method ensures you are paid accurately and in compliance with local regulations.

We offer four tailored solutions that give you the freedom to work or contract in 60+ countries, namely:

- Employed solution

- Self-employed solution

- Limited company solution

- Employer of Record solution

Our dedicated team of experts can advise what option suits you best, depending on your circumstances, ensuring maximum salary retention and complete compliance.

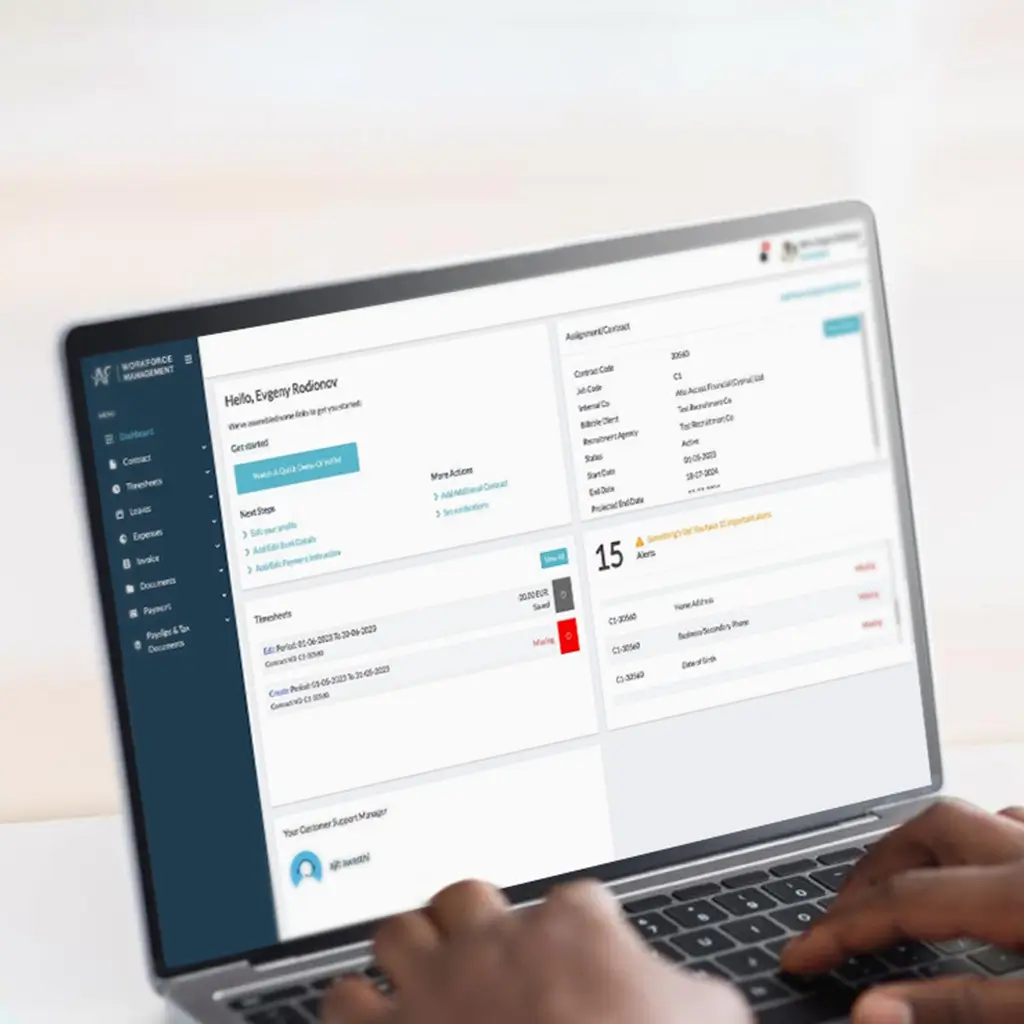

The global Workforce Management portal you deserve

Our Workforce Management portal is a web-based client self-service system designed to automate and boost your international employment.

Here are just a few benefits you’ll get when working with the portal:

- Our onboarding module allows contractors / employees to onboard on their own from one centralised interface;

- With WFM portal, contractors/employees can submit timesheets and expenses directly to the portal, eliminating manual data entry;

- In just two clicks, you can request time off and, if necessary, notify your line manager;

- Add multiple contracts and bank accounts for productive work with each employer/client around the world.

Take a look at how we can help you thrive

Agent of Record (AOR)

Our Agent of Record (AOR) service allows businesses to engage independent contractors worldwide with confidence.

Swiss Outsourcing

Access Financial is your expert in the Swiss market for recruitment businesses, companies seeking Employer of Record (EOR) services, and professionals looking to work in Switzerland.

Business Expansion

We provide corporates and recruitment agencies with a turnkey solution: we establish and manage your local infrastructure so you can concentrate on winning clients and placing talent.

Contract Management

Whether you are a freelancer or an employee needing compliant contracts, a recruiter looking to place talent quickly, or a business needing risk free engagement solutions, our team acts as your partner every step of the way.

Employer of Record (EOR)

We streamline your team management by overseeing hiring, payroll, taxes, benefits, and insurance, ensuring a seamless and compliant experience for your business.

Payroll Processing

Processing payroll is more than preparing payslips — it’s about accurate calculations, on time payments and strict compliance with tax and labour laws.

Immigration Assistance

Access Financial offers expert guidance and seamless solutions for all your international mobility needs.

Tax & Legal Compliance

Businesses, contractors and recruiters working internationally face complex labour and tax rules that vary by country and sector. Access Financial keeps pace with these changes so you don’t have to.

Benefits for

employees/contractors

Just some of the advantages of choosing Access Financial as your trusted partner:

- Ensuring maximum salary retention;

- Efficient tax plans utilising all legal and compliant options;

- Reduced administration;

- Payroll solutions tailored to personal circumstances;

- Immigration assistance and visa sponsorship in over 20 countries.

Country Explorer

If you are interested in getting detailed information about our solutions in any other country, please get in touch with us and we would be happy to share our experience and expertise with you.

Need an illustration?

Speak to us today

Our dedicated sales team is ready to provide you with a tailored quote and offer guidance on all aspects of the global mobility.

Over 22 years of professional global mobility and payroll management experience.

We’re all set up in-country so onboarding takes days, not months.

We offer immigration assistance and visa sponsorship in over 20 countries.

Our customised software is designed to manage payroll more efficiently, saving clients time and avoiding errors.

Ready to make Global Mobility easier?

Employees/Contractors FAQs

What is an umbrella company?

An umbrella company is an organisation that employs contractors as part of its business operations. Some umbrella companies, such as contract management or Agents of Record businesses, can offer services to self-employed individuals as well as those working through their own limited companies. Access Financial provides assistance in all three areas.

What are the advantages of an umbrella company?

The advantages of an umbrella company include providing a legal means of working that complies with local legislation. Without an umbrella company, a recruitment business would have to employ their contractors directly, which they may not have the experience and expertise to do. A competent umbrella company will ensure that you pay the correct amount of tax and social charges, neither less nor more than is required by law.

How can I calculate my take-home pay?

Use one of our online calculators to get a free simulation – https://accessfinancial.com/#tax-calculator

How do I get paid?

Our company provides services in 60 countries globally and makes payments to the contractor/employee’s bank account in the currency they specify.

Can I work simultaneously with different clients?

If your contract does not prohibit it and your legal rights allow, you are free to work as you wish. However, there may be restrictive covenants in your contract, and many clients will be concerned about your focus being on their work and keeping their data confidential.

What is an Employer of Record service?

An Employer of Record (EOR) is a service or organisation that legally employs people on behalf of other companies. This setup is especially useful when companies want to hire employees in different regions or countries where they do not have a registered business entity. Access Financial is an EOR provider and helps employers hire employees in various parts of the world where their skills are needed.

Still have more questions? Contact support