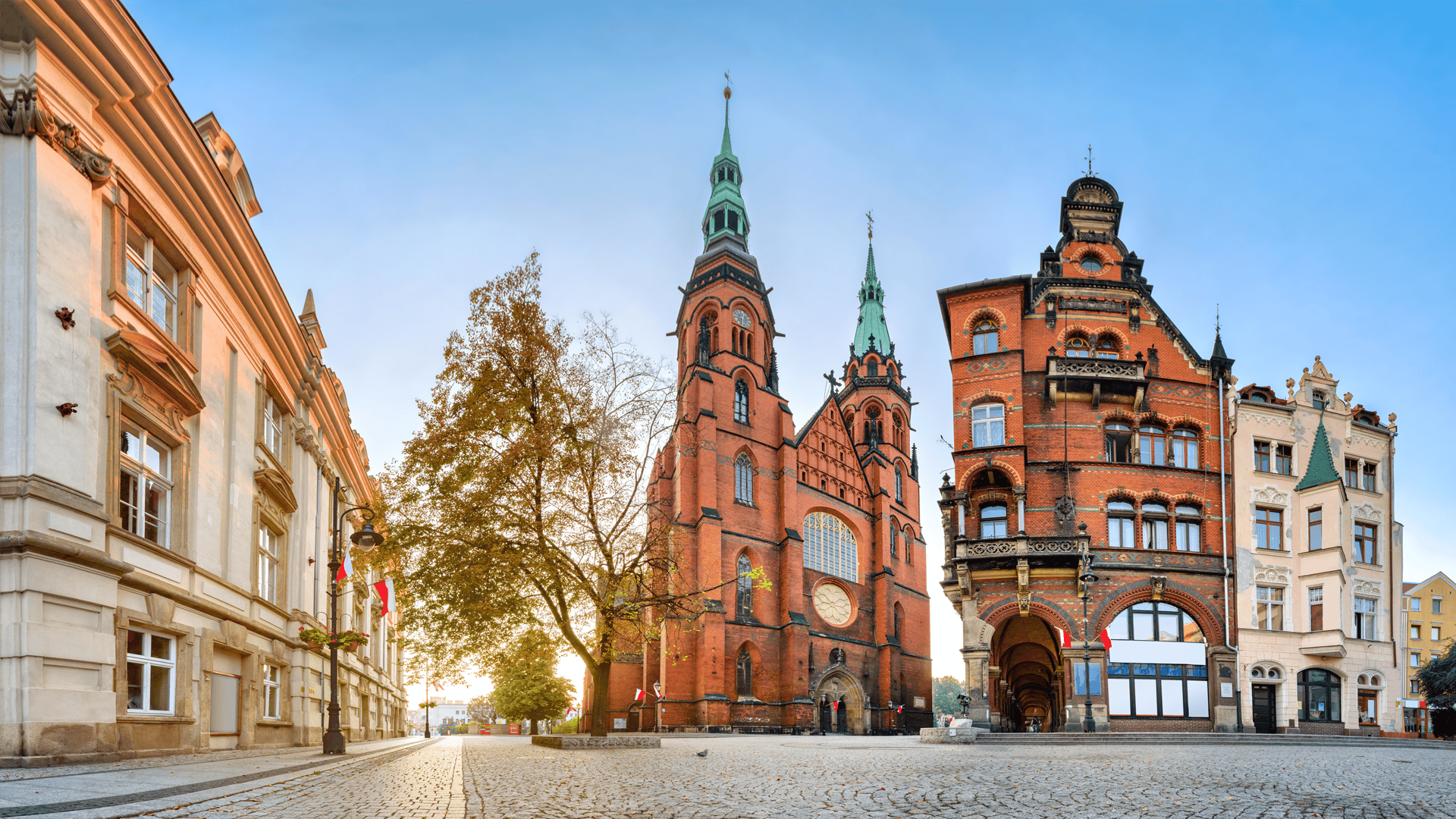

Country Overview

Poland is a popular place to relocate to, with a growing economy, affordable living costs, and lively cities rich in history, culture, and opportunity.

This comprehensive guide is designed to simplify your transition to Polish life, detailing essential steps and practical tips to ensure a smooth and less stressful relocation. From obtaining the necessary visas to understanding the cost of living, setting up bank accounts, and securing health insurance, this guide covers all critical aspects of starting your new life in Poland.

Whether you’re planning your move or already packing your bags, this step-by-step guide will help you manage the practicalities of living and working in Poland.

22

years of experience confirm our competence

Self-Employment in Poland

We will compliantly register you as a self-employed person (independent) and assist with filing obligations throughout your contract term. We’ll deregister you if/when you end your assignment in Poland and close-off any final compliance reporting requirements.

To maintain eligibility, it is essential to ensure there is no employment or subordinate relationship with the client. Should such a relationship be found, defending your self-employed status before the tax authorities can be difficult. In such cases, both you and the client risk being subject to a deemed employment ruling, which could result in employer social security contributions becoming payable.

OUR SOLUTIONS:

Self-Employed

SERVICES

Agent of Record (AOR)

Our Agent of Record (AOR) service allows businesses to engage independent contractors worldwide with confidence.

Employer of Record (EOR)

We streamline your team management by overseeing hiring, payroll, taxes, benefits, and insurance, ensuring a seamless and compliant experience for your business.

Payroll Processing

Processing payroll is more than preparing payslips — it’s about accurate calculations, on time payments and strict compliance with tax and labour laws.

Business Expansion

We provide corporates and recruitment agencies with a turnkey solution: we establish and manage your local infrastructure so you can concentrate on winning clients and placing talent.

Immigration Assistance

Access Financial offers expert guidance and seamless solutions for all your international mobility needs.

Contract Management

Whether you are a freelancer or an employee needing compliant contracts, a recruiter looking to place talent quickly, or a business needing risk free engagement solutions, our team acts as your partner every step of the way.

Tax & Legal Compliance

Businesses, contractors and recruiters working internationally face complex labour and tax rules that vary by country and sector. Access Financial keeps pace with these changes so you don’t have to.

Need an illustration?

Speak to us today

Our dedicated sales team is ready to provide you with a tailored quote and offer guidance on all aspects of the global mobility.