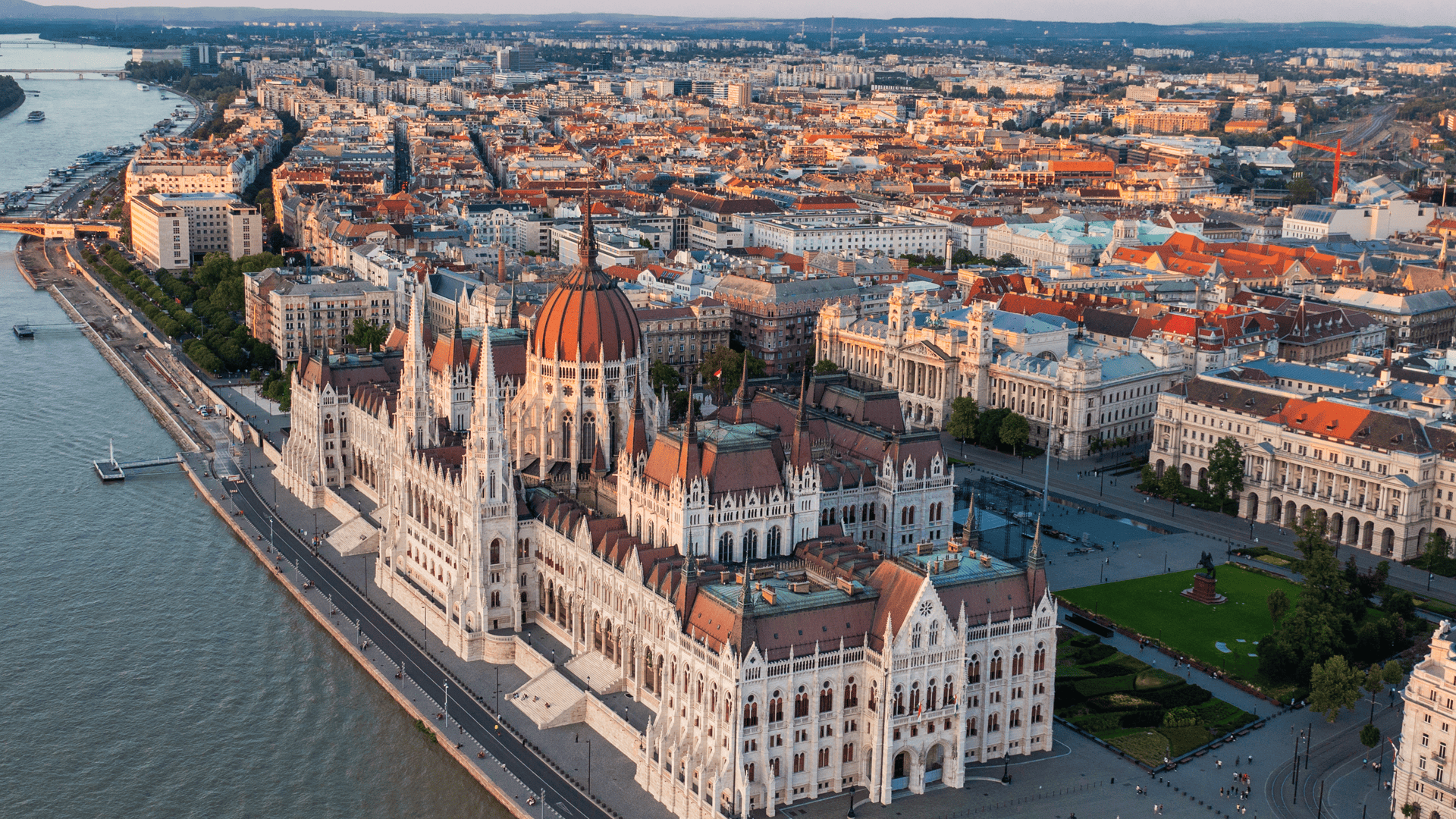

Country Overview

Hungary is a popular place to relocate to, offering a rich cultural heritage, affordable living, and dynamic cities like Budapest that attract both professionals and families.

This comprehensive guide is designed to simplify your transition to Hungary life, detailing essential steps and practical tips to ensure a smooth and less stressful relocation. From obtaining the necessary visas to understanding the cost of living, setting up bank accounts, and securing health insurance, this guide covers all critical aspects of starting your new life in Hungary.

Whether you’re planning your move or already packing your bags, this step-by-step guide will help you manage the practicalities of living and working in Hungary.

22

years of experience confirm our competence

Employment in Hungary

Our solution for contractors in Hungary is to operate through our umbrella company. We handle all billing, payments, and withholding tasks on your behalf. You’ll receive full administrative support from the umbrella company while remaining responsible for your client work and deliverables.

OUR SOLUTIONS:

Employed

SERVICES

Contract

Management

We take care of all onboarding procedures, payroll, compensation and benefits, tax filing, and termination of employment in 60+ countries.

Payroll

Outsourcing

Our payroll services are fully compliant and designed to make the most of your contractor revenue.

Tax & Legal

Compliance

We offer personalised consultations for all contractors to evaluate your specific needs prior to your relocation to the work country, throughout your stay, upon your return, and following your arrival back home.

Work Permits &

Immigration Assistance

Our immigration experts will navigate through the requirements and processing times, as they vary by country, for you.

Need an illustration?

Speak to us today

Our dedicated sales team is ready to provide you with a tailored quote and offer guidance on all aspects of the global mobility.