- Where should you choose to work?

- How do you find a job?

- Visas and best locations

- To end, a few questions?

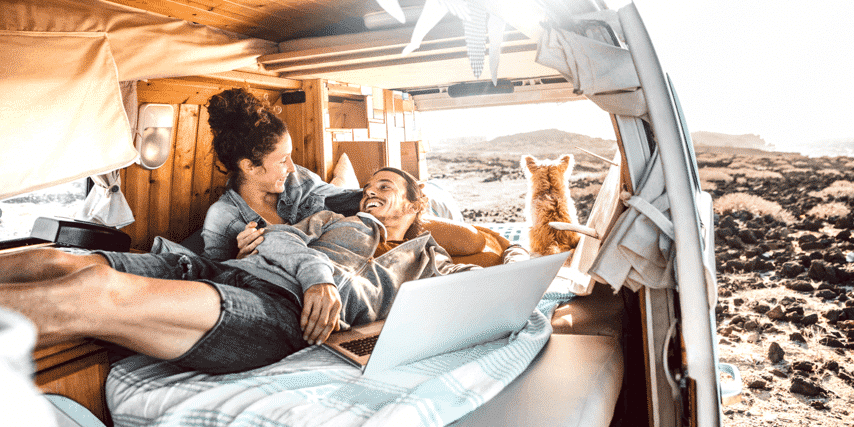

More companies are finding that it suits them to have staff working from home. Many workers are finding they like this newfound freedom. Many are attracted to the idea of not being tied to an office. We will not talk about the pros and cons of remote working vis a vis working from the officer nor of hybrid working. Instead, we will look at the practicalities of becoming a so-called Digital Nomad.

We will take you through what it means to be a Digital Nomad and how you can make this work for you in terms of the work experience, finding a role, immigration, the tax implications, and avoiding pitfalls.

We are receiving queries every day from both new and existing clients, so we know this is a hot topic with legs.

A Digital Nomad (DG) can work remotely from the place or places of their choice. A DG can operate in several ways. They can be an independent entrepreneur, a contractor or an employee. The common factor is that they work remotely with their client or customers and communicate via the cloud.

The requirements are very scant. The bare minimum would be a smartphone, and you will undoubtedly need a reliable and reasonably quick internet connection. You may also want to think about using a Virtual Private Network to maintain data security and, possibly, to disguise that you are working from a sandy beach in Barbados!

You might want to share space at a WeWork or a Regus. A fixed base may discipline you better. Another big plus is that it provides some human company.

Where should you choose to work?

Subject to obtaining the legal right to work somewhere, the world is your oyster. Several countries encourage DGs and give residence rights and attractive tax breaks to people like you. If you have a British passport, even post-Brexit, there are many jurisdictions you can travel to visa-free and where you may work remotely, subject to time limits.

DGs can perform any number of paying tasks. Essentially, unless you are in manufacturing, warehousing or retail, there is no end to what work you can do remotely. The key is that your clients or your employer are indifferent to your place of work and do not require you to show your face either to them or their clients.

How do you find a job?

You may not need to if you already have one. In which case, you need to agree with your employer that you work remotely. More and more corporates accept remote working post-COVID and, importantly, post-Brexit, and recruitment agencies can indeed find suitable work for you.

You can even find work on the many freelancer platforms, including Freelancer.com, Fiverr, etc. etc.

Visas and best locations

It is vital to think about where you have a legal right to live and work. In these jurisdictions you can go there and work in heartbeat. Where you do not have a legal right to work, you must research if your chosen country will permit you to reside there on a tourist, business or work visas.

Work visas tend to be problematic as you usually need to have a local employer sponsor a work visa for you.

As we mentioned earlier, countries are begining to see an advantage in allowing DGs to come to work. In Crotia, for example, you can apply for a digital nomad visa/residence permit that allows you to stay as a short-term resident in Croatia for a maximum of 12 months.

Countries that currently offer visas for DGS include:

- Georgia

- Barbados

- Antigua & Barbuda

- Bermuda

- Cayman Islands

- Anguilla

- Montserrat

- Dominica

- The Bahamas

- Curaçao

- Costa Rica

- Croatia

- Czechia (Czech Republic)

- Estonia

- Iceland

- Germany

- Norway

- Portugal

- Spain

- Malta

- Dubai (UAE)

- Mauritius

- Mexico

- Cape Verde (Cabo Verde)

- Seychelles

- Taiwan

- Sri Lanka

- North Macedonia

- Thailand

- Belize

- Greece

- Romania

- Cyprus

One hurdle you may have to overcome is opening a local bank account. If this does prove to be a hurdle, then company like Revolut, Monzo or Wise may well be the answer for you, enabling you to receive funds in any denomination and convert them to the currency where you are staying, as and when you need to.

To end, a few questions?

- Do you want to shift from your usual surroundings and experience the world, staying perhaps in several places throughout the year?

- Will the work that you can do sustain you as a DN?

- Are you able to apply for the immigration you will need alone, or do you need help?

- Do you have travel insurance?

- Do you have medical insurance, or can you get covered under governmental reciprocal arrangements?

- Speak to an expert on your tax situation? You may find that being a DG is transformational regarding your tax liabilities.

Website: https://accessfinancial.com

Contact us: https://accessfinancial.com/#contacts

Subscribe to our social media pages:

Linkedin – https://www.linkedin.com/company/access-financial/

Youtube – https://www.youtube.com/accessfinancialaf

Facebook – https://www.facebook.com/accessfinancialaf

Twitter – https://twitter.com/AF_Consultancy