- What are the strategic benefits?

Non-Doms are exempt from the Special Defence Contribution (SDC), a tax imposed on dividends, interest, and rental income, which offers significant advantages for individuals with substantial investment income.

Cyprus does not have wealth or inheritance taxes, which makes it an attractive jurisdiction for estate planning and wealth management.

Cyprus’s corporate tax rate is 12.5%, one of the lowest in the EU. Combined with the Non-Dom tax benefits, this makes Cyprus particularly appealing for establishing business operations.

Non-Domiciled residents are exempt from paying capital gains tax on the sale or disposal of non-Cyprus assets. This exemption is beneficial for individuals with international investments.

Cyprus provides competitive personal income tax rates in addition to the advantages of the Non-Dom status.

Non-Domicile Status is applicable to individuals who have not been tax residents in Cyprus for at least 17 out of the last 20 years. To qualify, individuals must meet one of the following criteria:

- 183-Day Rule: Spend a minimum of 183 days in Cyprus during a tax year.

- 60-Day Rule: Spend at least 60 days in Cyprus within a year, maintain a permanent residence, and engage in business activities or employment in Cyprus.

What are the strategic benefits?

The Non-Dom status allows individuals to optimize their global tax liabilities while enjoying the benefits of living in an EU country.

Cyprus is particularly appealing for wealth preservation due to the absence of wealth and inheritance taxes, making it an attractive jurisdiction for passing on assets across generations.

Additionally, its low corporate tax rate and favorable tax regime for individuals make Cyprus an ideal destination for entrepreneurs and investors.

Cyprus has double taxation agreements with over 60 countries, which enhances its attractiveness for international tax planning.

As a member of the European Union, Cyprus provides political and economic stability, along with access to the European market.

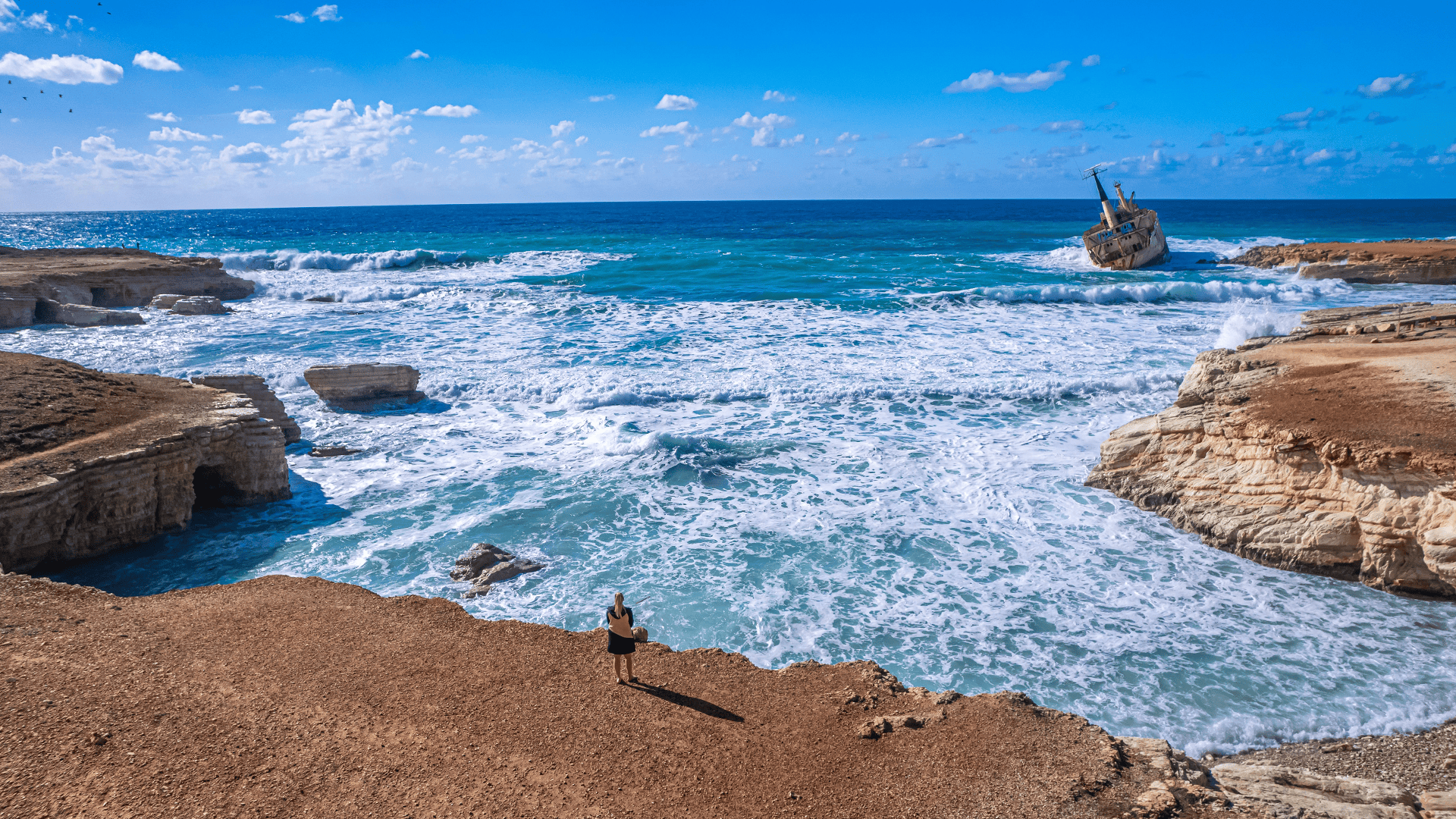

In addition, Cyprus boasts a high quality of life, characterized by a Mediterranean climate, stunning scenery, and a relaxed pace of living. Many residents speak English.

The Non-Dom Tax Status in Cyprus offers a compelling combination of tax advantages, strategic benefits, and an appealing lifestyle, making it a popular choice for expatriates seeking long-term wealth planning.

Disclaimer: The information provided here is for general knowledge and informational purposes only; it does not constitute tax advice. It is important to consult with a qualified tax advisor to understand the specific implications of Cyprus’s non-domicile tax status in your individual circumstances.