- Five fundamental parts to the UK Statutory Residence Tax

- Complicated, connections, and a chart -- to help

- Do you fall (or succeed) at the first three hurdles?

- Chart ‘notes’ for contractors:

- Finally, get expert help on your tax residency status

The Statutory Residence Test (SRT) allows contractors and other individuals to determine residence status for a tax year, writes Kevin Austin, manging director of Access Financial.

Each tax year is looked at separately, so you may be resident in the UK in one year but not the next, or vice versa.

Five fundamental parts to the UK Statutory Residence Tax

The SRT factors-in the amount of time you spend and, where relevant, work in the UK, together with the ‘connections’ you have with the UK. The SRT is comprised of five fundamental parts:

- Automatic overseas tests

- Automatic UK tests

- Sufficient ties test

- Split years

- Application of the SRT to deceased persons (not covered in this article)

If you have been in the UK for 183 or more days, you will be a UK resident; there is no need to consider other tests.

You will be resident in the UK for a tax year and at all times in that tax year if:

· you do not meet any of the automatic overseas tests.

· you meet one of the automatic UK tests or the sufficient ties test.

Complicated, connections, and a chart — to help

The rules are pretty complicated because there are three aspects to the Automatic Overseas Tests and three aspects to the Automatic UK tests.

Also, you need to look at the number of ties or connections you have in the UK, as these will determine whether you are a UK tax resident, depending on how many days you spend in the UK.

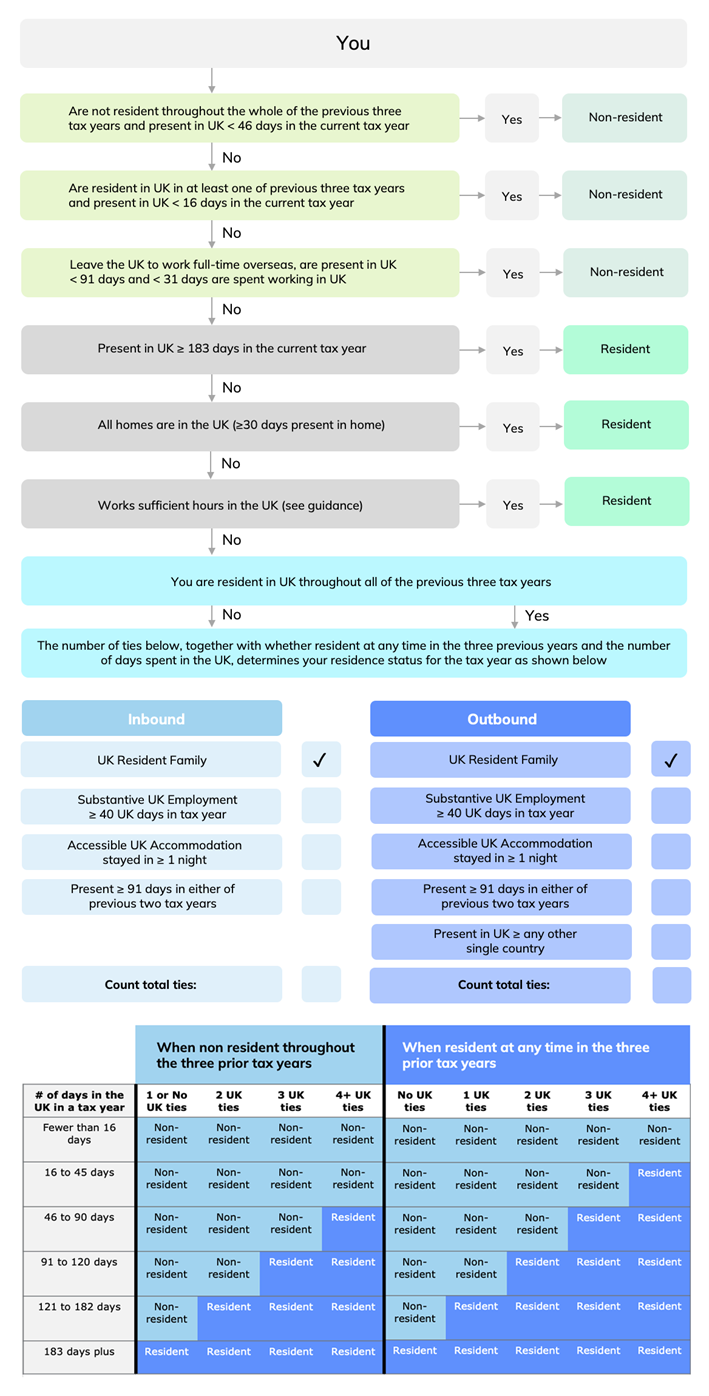

The easiest way to navigate the rules is to follow the flow chart below.

Work your way down the questions.

Do you fall (or succeed) at the first three hurdles?

You are a non-tax resident if you answer the first three questions with a ‘Yes.’

If you answer ‘Yes’ to any of the chart’s next three questions in the chart, you are a UK tax resident.

If it turns out that you have not been resident in the UK throughout the previous three years, you then have to consider the number of ties/connections you have to the UK.

Depending on whether you were a non-resident throughout the last three tax years, or were a resident at any time in the three prior tax years, determines how many days you can spend in the UK without becoming a tax resident.

So yes contractors, it isn’t easy, and HMRC has excelled here, complicating the matter.

The following chart, largely modelled on a helpful graphic by professional services firm KMPG, should enable you to find out your residence status under the SRT. Explore it in conjunction with the notes below it, for a full understanding as a contractor:

Chart ‘notes’ for contractors:

What’s in a day?

If you are in the UK at the end of a day, you are considered to be in the UK for SRT purposes.

However, certain exceptions apply, such as transit days with no work or being in the UK due to specified exceptional circumstances for a maximum of 60 days. HMRC can reduce your UK day-count to take into account days spent in the UK due to exceptional circumstances. Recently, HMRC made potentially helpful concessions for those who could not leave the UK due to the government’s COVID-19 travel restrictions.

Working Full-Time Overseas (‘WFTO’): definition

To be classified as WFTO, you must work an average of 35 hours per week overseas, disregarding certain defined days, be spending fewer than 91 days in the UK, and work in the UK for fewer than 31 days in the tax year.

Do you have a home in the UK, and what’s your duration in the residence?

You may be considered a UK resident if you have a home in the UK for more than 90 days in which you are present in, at least 30 separate days in the relevant tax year. Specific conditions apply to consecutive days and having no home overseas.

Works Sufficient Hours in the UK (‘WSHUK’): definition

To meet this criterion, you must work an average of 35 hours per week, with certain considerations in the UK over a 365-day period. More than 75% of days with more than three hours of work must be in the UK, and you must work for more than three hours in the UK on at least one day in the current tax year.

What’s in a ‘work-day’?

A workday in the UK is defined as a day on which more than three hours of work are performed, including both incidental and non-incidental duties and most travel.

Sufficient Ties Test – where it comes in

When you do not meet any of the automatic overseas or UK tests, your residence status depends on the number of UK ties (connections) you have and the number of days you spend in the UK.

What constitutes having a UK resident family?

A family tie exists if your spouse, civil partner, minor child, or someone you are living with as if married or civil partner is a UK resident. Special rules apply to children under 18-years-old in full-time education.

Split years, possibly

Special rules apply when you start or cease residence, including the possibility of splitting the tax year into an overseas part and a UK part for certain purposes.

Finally, get expert help on your tax residency status

The notes, chart and preceding guidance should at least HELP you determine your tax residency status in the UK, which can have significant implications on your tax liabilities – to HMRC and to non-UK tax authorities. And be aware, these two are increasingly working together, as I advised only last week!

But the information here is only a HELP. For guidance you can actually rely and act upon, there’s no substitute to consulting with a tax professional, overseas contracting adviser, or an in-country accountant. To inform your often free consultation with them, a good starting point is to consult the most recent set of tax regulations for the UK and your relevant territories alongside your own personal records for the last 12 months, so you can easily weigh up, check and count your particulars that determine tax residency status. Good luck!