What types of contracts are common for contractors in Belgium?

This article will examine only contracts for independent self-employed contractors working in Belgium. It will not discuss employment agreements, which must reflect Belgian employment law and are an entirely separate matter.

There are several contractor contracts as follows:

Independent Contractor Contracts

The independent contract is the most commonly used form of contracting, and the critical element here is to establish that the relationship between the end client and contractor is not one of employment but of self-employment. This is crucial to establish that there is no employee relationship for social security and tax purposes.

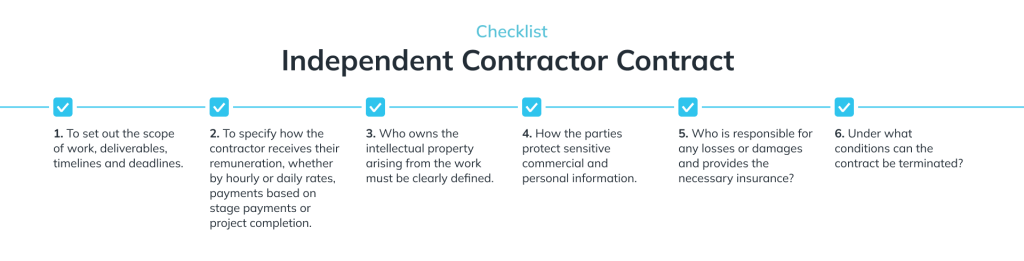

The fundamental elements of this type of contract are as follows:

Service Agreements

Particularly in the cases of marketing, IT consulting, or maintenance, the contract may be longer-term; there may be a service agreement. In all other respects, the requirements are the same as those for Independent Contractor Contracts.

Consultancy Agreements

Where advice rather than time spent is in point, as in instances of legal work, financial services, and management consulting, the focus is more on the consultants’ obligations and deliverables, on the client’s responsibilities to provide information, and on how and when payments are due.

Project Contracts

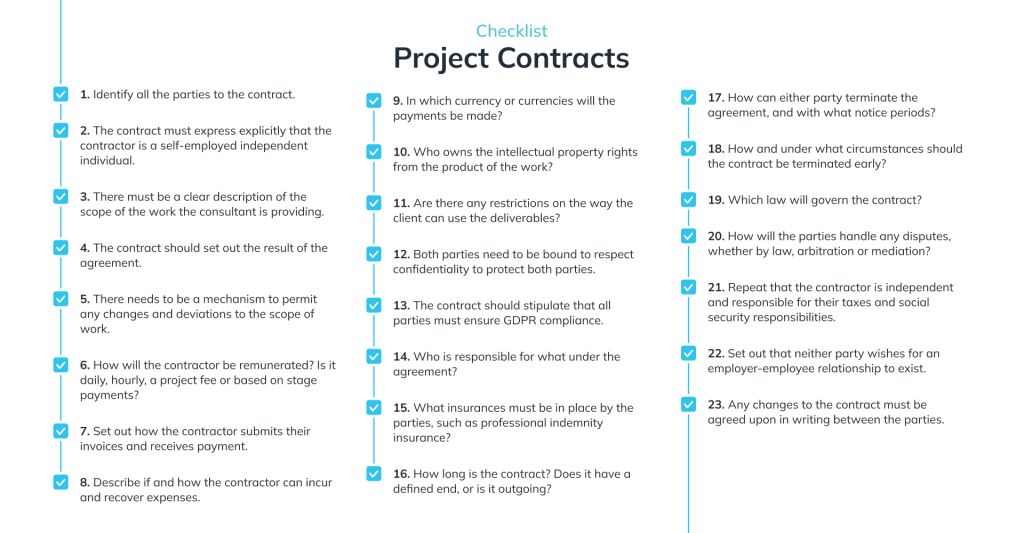

The fundamentals of project-based agreements are the start and end dates of the projects. They will concentrate on the project specifications, milestones, stage payments, and the criteria for deliverable acceptance.

What are the key clauses and terms you should include in contractor agreements?

There is little surprising here that the rubrics that need to be covered are as follows:

How can agencies protect their interests in contracts with clients and contractors in Belgium?

Provided agencies cover the above points, they should protect themselves against misclassification risks and the contract failing to deliver. In addition, they may wish to include non-compete and restriction clauses to prevent them from being excluded from the contract or having staff enticed away to the end client.

It is essential to understand that you must agree to and document restrictions such as these before offering assignments to contractors. Courts will not look kindly on impositions applied as a condition of providing a position to a contractor. The courts will always tend to rule in favour of the worker. If the worker claims that the relationship is one of disguised employment, it will be challenging, if not impossible, to enforce these restrictive clauses.

The main risk in Belgium is that the authorities claim the client-contractor relationship is disguised employment. Besides paying attention to the above points, you should do your due diligence on the contractor. To do this, check that they have the legal right to work, are registered as self-employed in Belgium, are registered for VAT, and have professional indemnity insurance.

In all cases, you should take proper local legal advice when drafting your contracts and not assume that Belgian law is identical to the law back home.