- What Is an Employer of Record (EoR)?

- Key Regulatory Updates (2025)

- Employment, payroll & compliance

- Immigration, visas & work permits

- Why choose Access Financial’s EoR?

- Onboarding & Management Process

- Who should use this service?

- Risks without EoR support

- Ready to Hire in Hong Kong?

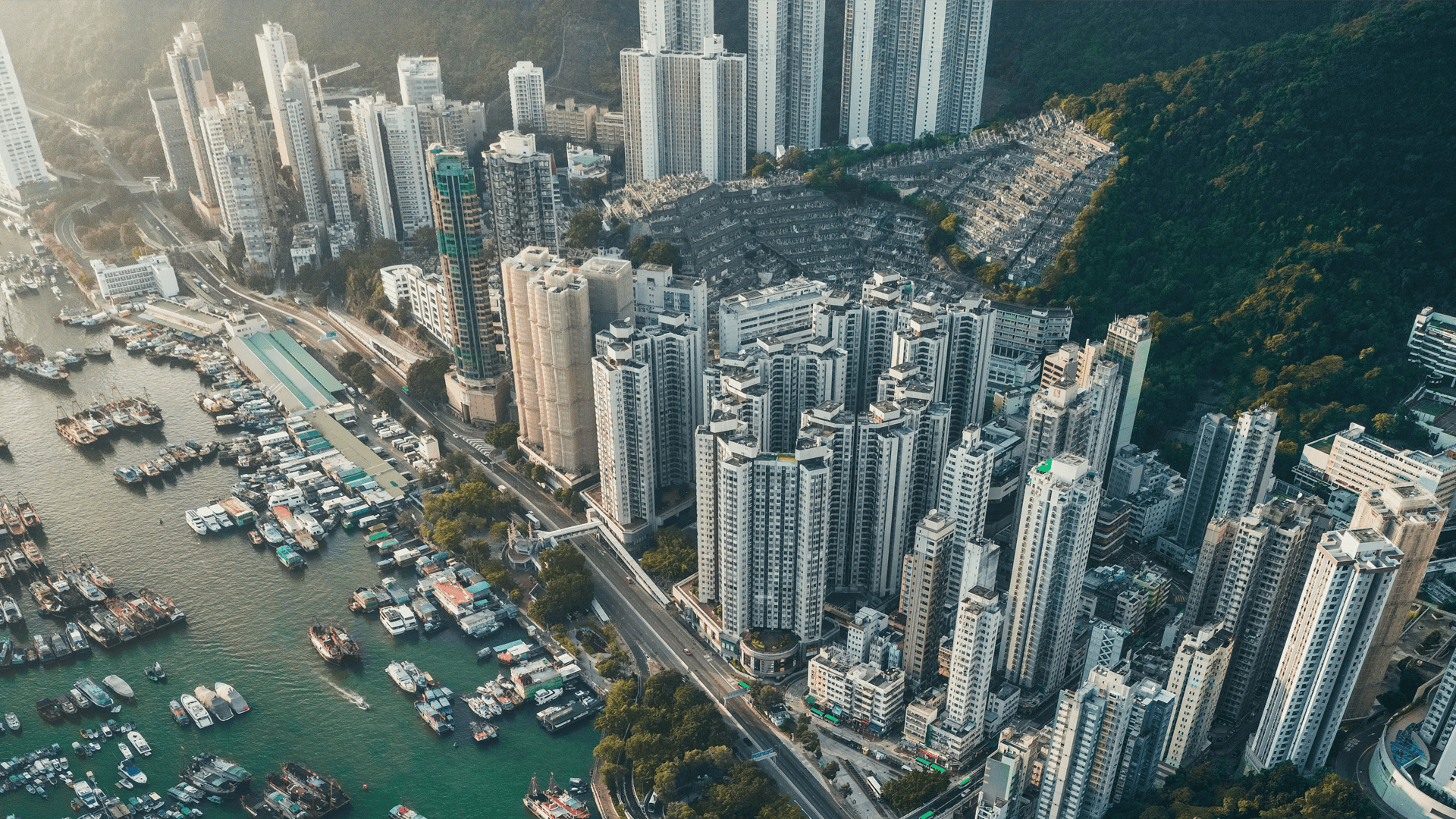

Hong Kong continues to be a premier Asia-Pacific hub, renowned for its global finance centre, low taxation and bilingual workforce. However, managing local compliance, especially without a legal presence, can be complex. Access Financial’s Employer of Record (EoR) service in Hong Kong allows you to employ staff swiftly, legally and without entity setup.

What Is an Employer of Record (EoR)?

An Employer of Record (EoR) acts as the official employer under local law, assuming full responsibility for payroll, contracts, tax and benefits, while you supervise the employee’s tasks and performance. With Access Financial as your EoR, you can:

- Issue contracts compliant with the Hong Kong Employment Ordinance

- Administer Mandatory Provident Fund (MPF) contributions

- Manage payroll, tax withholding and wage protection

- Handle work visas and ongoing legal compliance

You gain immediate access to the Hong Kong talent market, without having to establish a company locally.

Key Regulatory Updates (2025)

1. Reform to “Continuous Contracts”

Hong Kong’s Employment (Amendment) Bill 2025 has reduced the threshold for continuous employment from working 18 hours/week for 4 weeks (“4-18 rule”) to 68 hours across 4 weeks (“4-68 rule”), making more part-time workers eligible for statutory benefits.

2. Minimum Wage Increase & Wage Recording Cap

As of 1 May 2025, the Statutory Minimum Wage rose to HK$42.10/hour (approx US$5.40/hour). The monthly income threshold requiring employers to record hours also increased to HK$17,200/month (approx US$2,200).

3. Abolition of MPF Offsetting (May 2025)

The longstanding practice allowing employers to offset MPF contributions against severance or long-service payments was abolished from 7 May 2025 – employers must now fund both benefits independently.

4. eMPF Rollout

Hong Kong’s electronic MPF (eMPF) platform began launching in mid-2024, with full integration expected by end-2025. This simplifies contribution management and improves portability.

5. Late Wage Payment Penalties

Employers must now pay all wages within 7 days of each pay period’s end. Non-compliance can result in fines of up to HK$350,000, three years’ imprisonment, and public disclosure of convictions.

Employment, payroll & compliance

✔ Pay & Contracts

We issue employment contracts compliant with the Employment Ordinance, including working hours, leave entitlements, probation, termination notice and severance terms.

✔ Mandatory Provident Fund (MPF)

We enrol employees within 60 days and ensure monthly contributions are made via eMPF systems on time.

✔ Payroll & Tax

Our services include monthly salary processing, MPF deductions, tax filings and issuance of pay slips.

✔ Leave & Benefits

We administer statutory provisions – annual leave, sick leave, maternity/paternity entitlements – and optional benefits as required.

Immigration, visas & work permits

For non-permanent residents, Access Financial supports:

- General Employment Policy (GEP) visa applications

- Hong Kong Identity Card and registration

- Renewals, change of employment and compliance with Immigration Department requirements

All visa support services are coordinated smoothly to avoid delays.

Why choose Access Financial’s EoR?

- Speed to market: Hire local or foreign talent in Hong Kong within days, not months, without entity registration.

- Full compliance: Our solution conforms with 2025 labour reforms, wage legislation, MPF rules and visa guidelines.

- Reliable payroll administration: With eMPF integration and strict wage timelines, we ensure timely and accurate payments.

- Immigration & HR support: We manage visas, ID registration and visa renewals, avoiding sponsorship and immigration issues.

- One provider, no hassle: Our team offers seamless integration across payroll, tax and immigration, thus eliminating multiple vendor complexity.

Onboarding & Management Process

- Consultation & Role Definition

- Contract Drafting & MPF enrolment

- Payroll Setup & Bank Details Capture

- Visa Application & Immigration Registration (if required)

- Onboarding, induction and benefit enrolment

- Monthly pay runs, contributions and compliance checks

- Renewal or offboarding support

Who should use this service?

- Startups & SMEs testing Hong Kong entry

- Multinationals relocating staff or expanding regionally

- Recruitment agencies placing Hong Kong-based roles

- Project-led teams requiring temporary hires

- Compliance-conscious companies avoiding entity costs and liabilities

Risks without EoR support

Without an EoR, companies may confront:

- Fines or imprisonment for late wage or MPF contributions

- Legal exposure from inaccurate contracts or severance miscalculations

- Penalties or criminal charges for wage non-payment

- Visa delays or rejections due to sponsorship errors

Access Financial mitigates these risks, providing a compliant and secure solution for hiring in Hong Kong.

Ready to Hire in Hong Kong?

With sweeping regulatory changes in 2025 – from wage increases to MPF reforms – employing locally demands precision and local knowledge.

Access Financial’s Hong Kong EoR service ensures your hires are fast, legal and confidently managed.

Contact us to discuss your Hong Kong hiring plans.

Discover More – Download the Hong Kong Guide