- What is an Employer of Record (EoR)?

- Key regulatory developments in 2025

- Employment, payroll & compliance in Malaysia

- Payroll & Tax

- Immigration & work permit handling

- Why use Access Financial’s EoR in Malaysia?

- Onboarding process

- Who is this for?

- Avoid common risks

- Ready to hire in Malaysia?

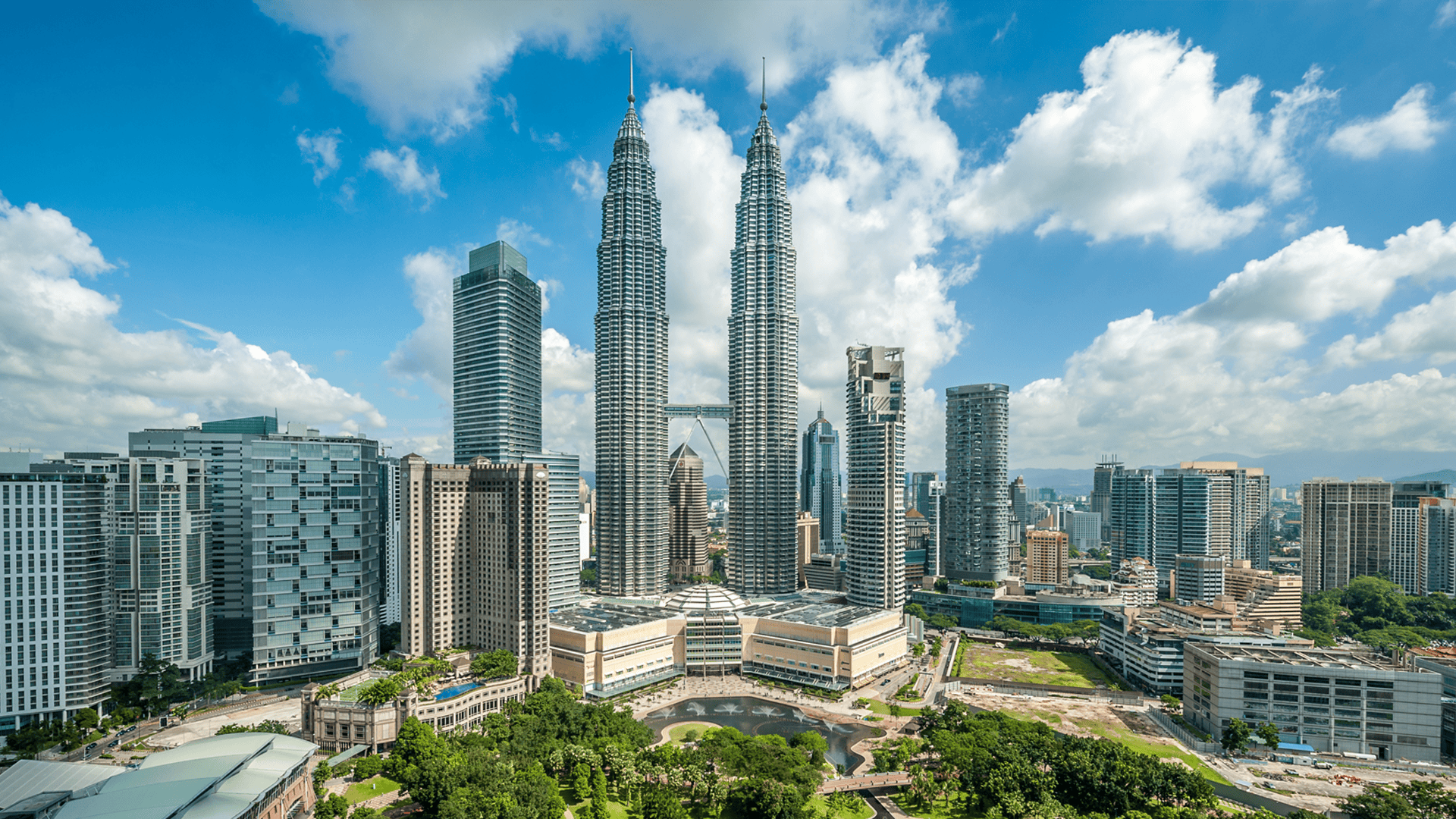

Malaysia continues to be one of Southeast Asia’s most attractive markets for global businesses. With its multilingual, educated workforce, competitive costs, and strategic access to ASEAN economies, Malaysia offers companies an ideal base for regional expansion.

However, as of June 2025, hiring in Malaysia requires careful navigation of new immigration systems, statutory regulations, and workforce compliance frameworks. Access Financial’s Employer of Record (EoR) service enables companies to hire both local and foreign talent in Malaysia – quickly, legally, and without establishing a local entity.

What is an Employer of Record (EoR)?

An Employer of Record acts as the legal employer of your staff in Malaysia while you manage their day-to-day duties and performance. As your EoR, Access Financial is responsible for:

- Issuing valid employment contracts

- Registering with all statutory authorities

- Managing monthly payroll and tax deductions

- Handling visa sponsorship and Employment Passes (EP)

- Ensuring compliance with local labour and immigration laws

This arrangement allows you to scale your Malaysian workforce without the time, cost, or complexity of incorporating a company locally.

Key regulatory developments in 2025

1. ePASS digital migration

Since March 2025, all Employment Pass (EP), Professional Visit Pass (PVP), Dependant Pass, and Long-Term Social Visit Pass applications must be submitted via ePASS, Malaysia’s fully digital immigration platform. The system requires accurate document uploads, real-time monitoring, and digital approval for work permits.

2. Cooling-off period for non-compliance

From July 2025, companies that submit incorrect, incomplete, or fraudulent information to the Expatriate Services Division (ESD) may be subject to a six-month suspension from submitting further visa applications. This makes accurate documentation and qualified immigration handling critical.

3. Intern-to-Expat quota

To boost local workforce development, employers sponsoring expatriates under EP Categories I, II, and III must comply with an internship placement quota:

- Category I: 3 local interns per expat

- Category II: 2 interns

- Category III: 1 intern

This quota applies per expatriate hire and is tracked via Malaysia’s MySIP portal.

4. Updated EP salary bands

EP categories continue to be enforced as follows:

- Category I: RM10,000+/month, up to 5-year pass

- Category II: RM5,000–9,999/month, 2-year pass

- Category III: RM3,000–4,999/month, 1-year pass (renewable twice)

Employment, payroll & compliance in Malaysia

Employment contracts

Written contracts must comply with the Employment Act 1955 (as amended), covering wages, leave, termination terms, and working hours.

Statutory registrations

We register employees with:

- EPF (Employees Provident Fund)

- SOCSO (Social Security Organisation)

- EIS (Employment Insurance System)

- LHDN (Inland Revenue Board)

Payroll & Tax

We manage monthly payroll, pay slips, PCB tax deductions, and annual income reporting.

Immigration & work permit handling

- ePASS submission and tracking for all EP applications

- Visa category selection and Change of Category letters for internal role changes

- Dependants’ visas for spouses, children, and parents

- On-arrival documentation and post-approval reporting to authorities

- Internship reporting to ensure compliance with EP quotas

Why use Access Financial’s EoR in Malaysia?

No Entity setup required

We hire through our own Malaysian entity, removing the need for company registration or HR infrastructure.

Full compliance with Labour & Immigration Law

We stay up to date with changes in immigration procedures, EP salary bands, internship quotas, and statutory contributions.

ePASS expertise

We ensure all Employment Pass applications are correctly prepared, avoiding costly delays or cooling-off penalties.

Integrated payroll & HR administration

All aspects of employment, from onboarding to pay slips and statutory filings, are managed under one roof.

Employee support

We provide onboarding packs, point-of-contact HR support, and issue resolutions for both employer and employee.

Onboarding process

- Provide consultation and role assessment

- Draft and issue a locally compliant contract

- Register with EPF, SOCSO, EIS, and LHDN

- Submit EP application via ePASS (if applicable)

- Process payroll and provide pay slips

- Ensure ongoing compliance, renewals, and reporting

Who is this for?

- Start-ups and SMEs entering the Malaysian market

- Enterprises relocating staff or setting up remote teams

- Project-based operations with short-term staffing needs

- Recruitment agencies requiring compliant placement models

- Multinationals needing a fast and risk-free entry route

Avoid common risks

Without EoR support, companies may face:

- Visa application errors and six-month suspension from ESD

- Failure to meet intern-to-expat quotas

- Incorrect tax or statutory filings

- Risk of misclassification or unlawful termination claims

- Delays and penalties from non-compliance with EP regulations

Access Financial protects you from these risks and enables compliant growth from day one.

Ready to hire in Malaysia?

Malaysia is a highly attractive but tightly regulated employment environment. With Access Financial as your Employer of Record, you can grow your Malaysian team safely, quickly, and compliantly, without the need to establish a local entity.

Contact Us:

Malaysia: +601 66999095

UAE: +971 503075121

Email: [email protected]